|

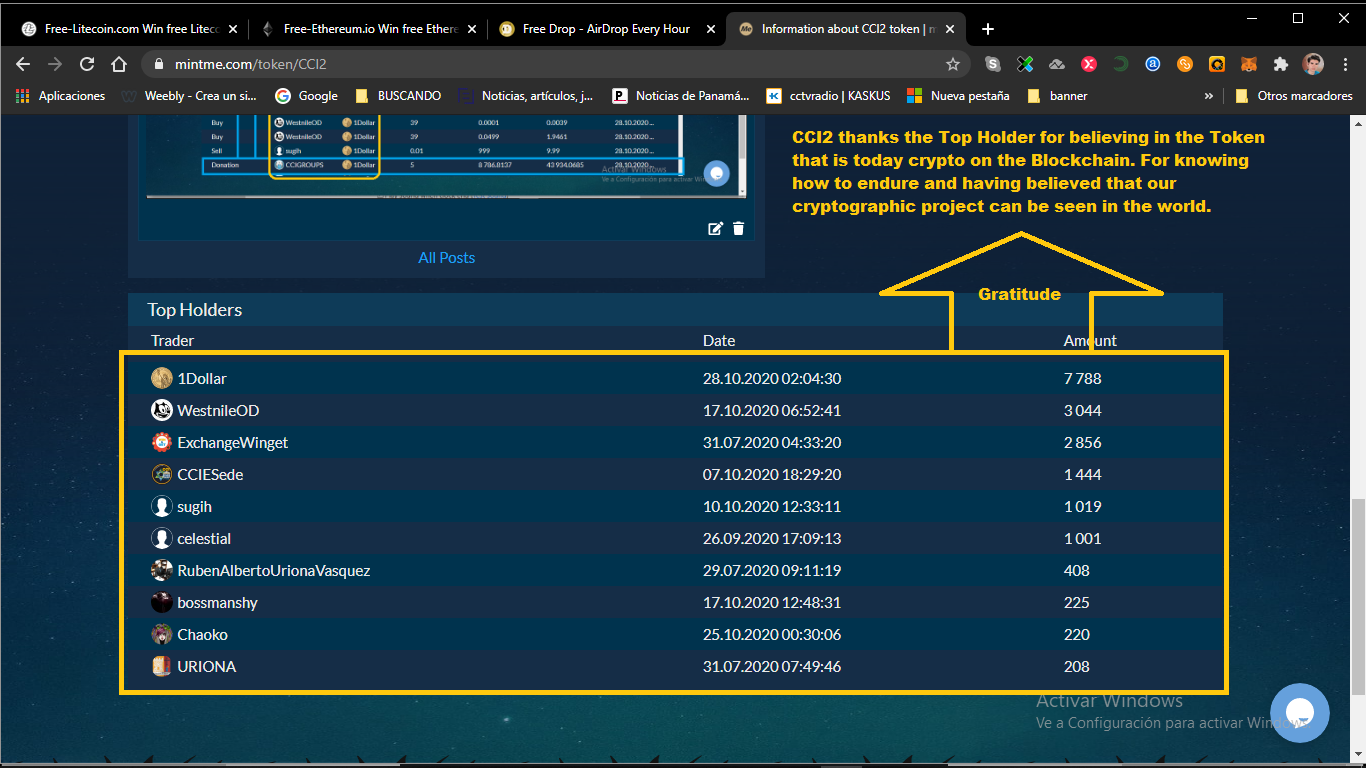

From our asset strategy report the INTI had a greater acceptance in the last days at the end of 2020 imposing a rise above the CCI, CCIE does not detract from the fact that the INTI asset, being a recent asset in the market, covers the expectations of the Holder and Exchange. (this information is also reflected in your asset table)

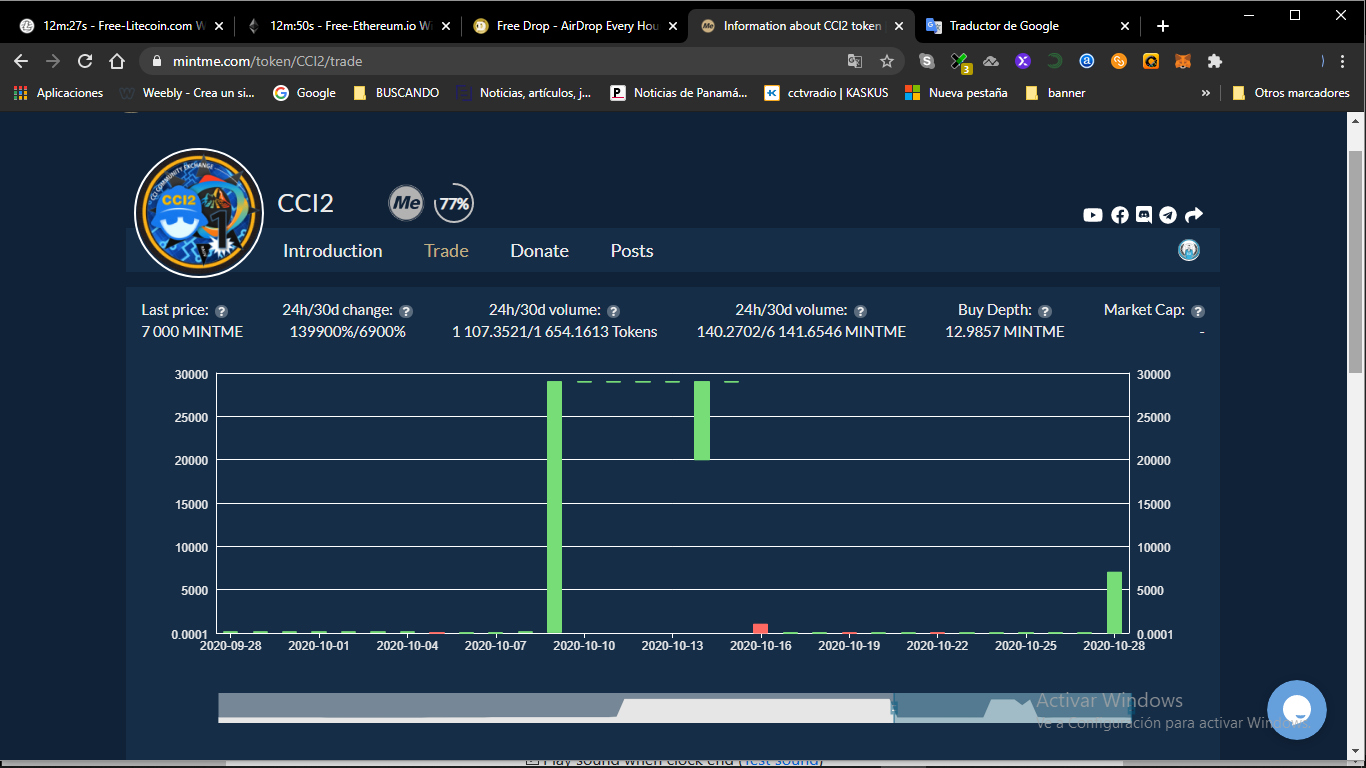

CCI began with greater sustainability when it passed USD $ 100 and today it is about to reach almost the peak value of USD $ 190 (this information is also reflected in your asset table) The CCIE had a slight increase from the cost of USD $ 0.00000012 to the value of USD $ 0.000258 (this information is also reflected in your asset table)

In the new energy vehicle category, which includes hybrid and pure electric cars, BYD sold more than 23,000 units in March, bringing the total in the first quarter to 53,380 cars. These electric vehicle sales figures come as China's automotive market is recovering from the coronavirus pandemic. New motor vehicle registrations in the first quarter of this year rose to a record 9.66 million, according to the Chinese Ministry of Public Security. New energy vehicles accounted for 466,000, or just over 6% of newly registered cars, the data showed. The percentage of renewable energy cars nationwide that are purely electric was 81.5% in the first quarter, roughly the same figure as in 2020, according to Public Safety data. However, in the global market context, China's electric car manufacturers still have a long way to go. Electric car market leader Tesla (NASDAQ: TSLA) reported last week that it delivered 184,800 cars worldwide in the first quarter. While the manufacturer did not disclose figures for China, the company said in a statement: "We are encouraged by the strong reception of the Model Y in China and are progressing rapidly towards full production capacity." Elon Musk's firm began deliveries of its China-made Model Y last January. This car was the third best-selling renewable energy vehicle in China in February, according to the China Passenger Car Association.  Kimbal Musk, the younger brother of the CEO of Tesla (NASDAQ: TSLA), has made more than $ 7 million trading shares of the electric vehicle maker: He acquired shares through options and sold them on the same day at an average price of $ 600 more than what you paid for them. In a filing with the Securities and Exchange Commission (SEC), Tesla reveals that Kimbal, who sits on the company's board of directors, exercised options to buy 12,000 common shares on April 1 at a price of $ 74.17 per share, for $ 890,040.00. That same day, Kimbal sold 12,000 shares on the open market at an average price of $ 675.856, according to MarketWatch calculations, to raise $ 8,110,149.46. In net terms, Kimbal made $ 7,220,109.46. The company said the stock sales were part of a Rule 10b5-1 business plan adopted by Kimbal on May 19, 2020. Rule 10b5-1 allows, under SEC rules, the major shareholders and insiders of publicly traded corporations to trade a predetermined number of shares at a predetermined time. Also read: Pfizer and Moderna: The curious 10b5-1 plan or how to get (more) rich in a minute Elon Musk's brother still owned 599,740 Tesla common shares after the sale, which at current prices were valued at around $ 414.7 million. He also benefited from options to buy 197,250 shares. As MarketWatch recalls, Kimbal has been pretty good at picking short-term highs in Tesla stocks in recent months. The last time he sold shares was on February 9, at a weighted average price of $ 852,117. The stock closed that day at $ 849.46 and has since closed below that level.  BTC returns to $ 35 thousand BTC returns to $ 35 thousand This Wednesday, the main indices around the world were trading higher after the appearance of the candidate to be the next Treasury Secretary, Janet Yellen, who on Tuesday called for a larger economic stimulus package. Futures: Last checked on Wednesday, Dow futures were trading 0.11% higher and S&P 500 futures were up 1.06%. WTI crude oil futures are trading 1.23% higher at $ 53.63, while gold futures are up 0.79% at $ 1,854.70. The 10-year Treasury yield is unchanged at 1.092%. VIX futures climbed 8.07% to $ 25.10. Cryptocurrencies: Bitcoin was trading 5.72% lower at $ 35,166 the last time it was queried, while Ethereum is down 1.73% to settle at $ 1,355.70 after reaching a new all-time high. Ethereum is the second largest cryptocurrency by market capitalization and has been boosted by a decentralized finance (DeFi) ecosystem. Asia: Japan's Nikkei 225 closed 0.38% lower, as gains in mining stocks were more than offset by losses in airline and bank stocks. Japan has a fairly busy schedule of economic events for Wednesday, in which data on the producer price index (PPI), the trade balance and foreign investment are scheduled to be published. In principle, the Bank of Japan could make its decision on the interest rate public today. China's Shanghai Composite Index closed 0.47% higher after the People's Bank of China kept the prime rate unchanged at 3.85%. Commodities and industrials stocks rose on Wednesday, partially offset by the decline in bank stocks. Australia's S & P / ASX 200 closed 0.41% higher, close to its 11-month high, fueled by optimism around domestic corporate earnings. The country's unemployment data is scheduled to be released today. The Hang Seng of Hong Kong rose 1.08%. Shares of Alibaba Group Holding Ltd (NYSE: NYSE: BABA ) gained 8.5% in Hong Kong, after its founder, Jack Ma, made a public appearance online after months of unaccounted for. India's Nifty 50 Index is trading 0.92% higher , driven by gains in auto, public sector bank (PSU) and technology stocks. Tata Motors (NS: TAMO ) (NYSE: TTM) had rebounded 6.2% at press time , after the company announced the obtaining of 98 patents related to electric and connected vehicles. South Korea's KOSPI advanced 0.71%, with all the attention focused on the PPI data. Europe: The Euro Stoxx 50 Index is trading 0.51% higher at press time . The bloc's economic sentiment rose to 58.3 in January, while construction sector activity grew 1.41% month-on-month in November. The CPI data is scheduled to be released today. The FTSE 100 in London trading almost unchanged at the close of this edition, after the CPI to rise 0.3% MoM in December and PPI increased by 0.8% MoM. The DAX in Germany is trading 0.59% to the upside after the December PPI grew by 0.8% MoM. Auto stocks drive the index higher as Daimler AG (DE: DAIGn ) (OTC: DDAIF) rose 2.1% after Warburg Research analyst Marc Rene Tonn held the ground. Buy rating for the stock. The CAC 40 in France has risen by 0.49% and the IBEX 35 in Spain quoted 0.12% to the upside at the time of publication. Foreign exchange market: For its part, the US dollar index futures fell 0.06% to settle at 90.422. The dollar has weakened 0.46% against the British pound, has lost 0.10% against the Japanese yen and is down 0.15% against the Chinese yuan , but has strengthened 0.03% against to the euro. Read the article also in Benzinga Spain

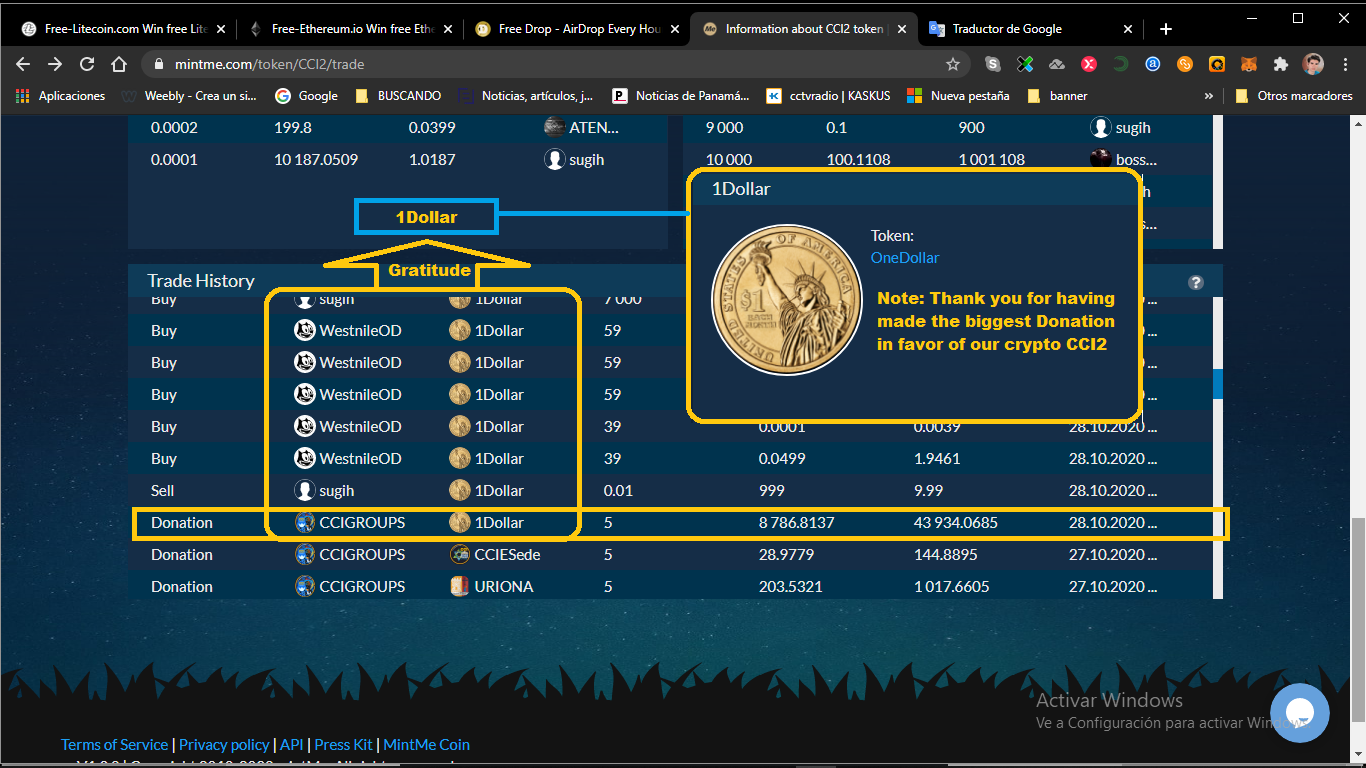

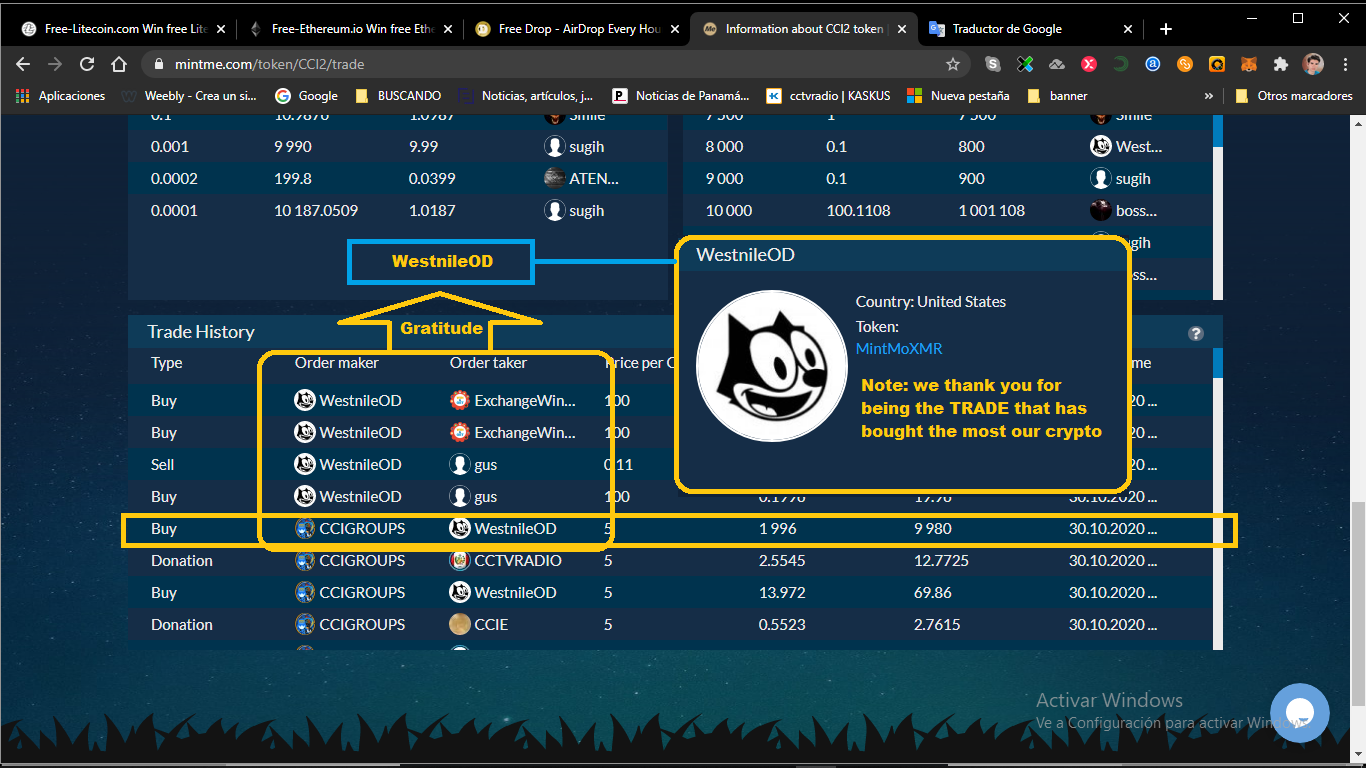

We are going to give a public thanks to 2 HOLDER TRADER

We will make a public thank you to ALL OUR TOP HOLDER

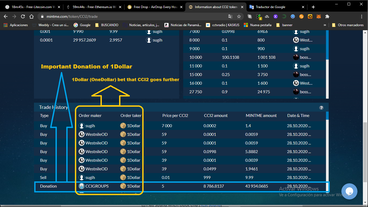

An important ally is always the FINANCING of companies and this is the case of OneDollar that surprises us with an Important Donation for our crypto CCI2 from now on we will be supporting OneDollar in the same way with a strategic alliance between our CCI Community Bank with OneDollar. believe that both financial social reasons unite us with the desire to exist in the Blockchain world and to participate for community support |

AuthorCCI COMMUNITY BANK ArchivEs

August 2021

CategorIEs

All

IMPORTANT LINKS |

|

Protection and Satellite Tracking | © COPYRIGHT 2010 - 2100 - CCI Community Bank | © COPYRIGHT 2010 - 2021 - CCI Community Exchange . ALL RIGHTS RESERVED. - SPONSOR CCTVRADIO Telegram Instagram Facebook Business Twitter Amino Hispalotto (Call Center) Phone: +972 55-508-6132 anexo 637339 E-mail: [email protected] | Phone: +1 515-606-5441 anexo 637339

E-mail: [email protected] | Phone: +51-1-6419465 anexo 637339 E-mail: [email protected] |

|

RSS Feed

RSS Feed